- Posted on:

- Related Parties: Saudi Arabia

Saudi Arabia started to apply 100% excise tax on all tobacco products in compliance with the agreed Gulf Cooperation Council tax increase to harmful products to human health and the environment in 2016. The Excise Tax Guidelines, adopted in June 2017, issued by the General Authority of Zakat and Tax (GAZT), comes in compliance with Article 6 of the WHO Framework Convention on Tobacco Control, which Saudi Arabia is Party to since 09 May, 2005, as one of the first countries to ratify the treaty.

Additionally, this policy also establishes the application process, through GAZT, for a Tax Warehouse License, which is recognized as a "designated physical space in which excise goods can be manufactured, processed, held, received, or dispatched by an authorized licensee in the course of his business under tax suspension".

The Party went beyond adopting a regulation from May 2019, which imposes a 100% excise tax also on electronic smoking appliances and tools, as well as on the liquids used in such smoking appliances and tools. This regulation enters into force in December 2019.

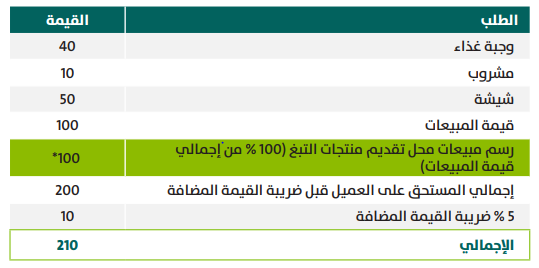

A decree from the Ministry of Municipal and Rural Affairs has also imposed a 100% tax on food and beverages in restaurants and cafes that serve tobacco products. Therefore, all customers of such food outlets will have to pay this tax, irrespective of whether they use tobacco products or not. This measure is expected to limit availability of tobacco products in restaurants and cafes, especially shisha, as a cost-effective measure to reduce tobacco supply.

For more information on this policy, please contact Saudi Arabia’s WHO FCTC focal point, Luluwah Mohamed Alghamdi, International Relations Coordinator (lmghamdi@moh.gov.sa).

General Authority of Zakat and Tax: Excise Tax Implementation - Excise Tax Guidelines - June 2017

General Authority of Zakat and Tax: Excise Tax Implementation - Excise Tax Guidelines - June 2017